Page 151 - Mono Technology Public Company Limited : Annual Report 2013

P. 151

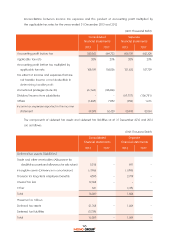

Reconciliation between income tax expenses and the product of accounting profit multiplied by

the applicable tax rates for the years ended 31 December 2013 and 2012

(Unit: Thousand Baht)

Consolidated Separate

financial statements financial statements

2013 2012 2013 2012

Accounting profit before tax 540,543 669,722 608,159 642,300

Applicable tax rate 20% 23% 20% 23%

Accounting profit before tax multiplied by

applicable tax rate 108,109 154,036 121,632 147,729

Tax effect of income and expenses that are

not taxable income or not deductible in

determining taxable profit:

Promotional privileges (Note 20) (67,563) (98,668) - -

Dividend income from subsidiaries - - (69,757) (106,781)

Others (1,468) 7,052 (932) 1,616

Income tax expenses reported in the income

statement 39,078 62,420 50,943 42,564

The components of deferred tax assets and deferred tax liabilities as at 31 December 2013 and 2012

are as follows:

(Unit: Thousand Baht)

Consolidated Separate

financial statements financial statements

2013 2012 2013 2012

Deferred tax assets (liabilities)

Trade and other receivables (Allowance for

doubtful accounts and allowance for sale return) 5,514 - 691 -

Intangible assets (Difference in amortisation) (7,095) - (1,098) -

Provision for long-term employee benefits 4,595 - 2,759 -

Unused tax loss 12,368 - - -

Other 647 (748)

Total 16,029 - 1,604 -

Presented as follows:

Deferred tax assets 21,768 - 1,604 -

Deferred tax liabilities (5,739) - - -

Total 16,029 - 1,604 -

145