Page 150 - Mono Technology Public Company Limited : Annual Report 2013

P. 150

17. Statutory reserve

Pursuant to Section 116 of the Public Limited Companies Act B.E. 2535, the Company is required to set

aside to a statutory reserve at least 5 percent of its net profit after deducting accumulated deficit

brought forward (if any), until the reserve reaches 10 percent of the registered capital. The statutory

reserve is not available for dividend distribution. At present, the statutory reserve has fully been set aside.

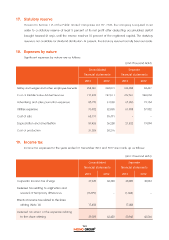

18. Expenses by nature

Significant expenses by nature are as follows:

(Unit: Thousand Baht)

Consolidated Separate

financial statements financial statements

2013 2012 2013 2012

Salary and wages and other employee benefits 258,067 224,073 106,908 94,497

Cost of Mobile Value Added Services 212,820 242,511 769,561 948,038

Advertising and sales promotion expenses 85,220 61,560 62,056 19,134

Utilities expenses 76,932 62,865 61,988 57,952

Cost of sale 65,191 35,491 - -

Depreciation and amortisation 59,426 36,200 21,832 19,094

Cost of production 31,025 30,276 - -

19. Income tax

Income tax expenses for the years ended 31 December 2013 and 2012 are made up as follows:

(Unit: Thousand Baht)

Consolidated Separate

financial statements financial statements

2013 2012 2013 2012

Corporate income tax charge 37,649 62,420 35,089 42,564

Deferred tax relating to origination and

reversal of temporary differences (16,029) - (1,604) -

Effects of income tax related to the share

offering (Note 16) 17,458 - 17,458 -

Deferred tax effect of the expenses relating

to the share offering 39,078 62,420 50,943 42,564

144